One of the lessons I’ve learned reading up on the crypto markets is that very few people truly understand virtual currencies and how they are valued and traded. Don’t get me wrong, there are lots of people who can talk up a storm about blockchain, digital ledgers, and the merits of digital currencies but knowing all the technical jargon and applications doesn’t necessarily mean a person understands them.

I’ve included a link to an interview with Michelle Bailhe Fradin, one of Sequoia Capital’s resident crypto experts, which I encourage you to watch at least the first few minutes. Media reports said Bailhe Fradin was instrumental in helping Sam Bankman-Fried (SBF) raise $150 million for his bankrupt FTX venture, which the storied VC firm has written off and apologized for making.

Bailhe Fradin, who has an undergraduate degree in human biology, might as well have given the interview in Greek because I didn’t understand the thesis she was advocating or the basis on which Sequoia makes its crypto investments. Admittedly, I possibly lack the technical smarts, but in my experience when people speak only in technical terms and can’t dumb down their messages, it often means they don’t know what they are talking about.

Pavel Pogodin, a Puerto Rico-based attorney whose bio says he has a doctorate in physics from the University of Iowa and is also fluent in Russian and German, strikes me as someone who really understands the crypto markets, no doubt to the displeasure of some of its participants.

In 2019, Pogodin filed a lawsuit against FTX and SBF’s sister trading firm Alameda Research, alleging some very damning accusations, including extensive market manipulation. SBF was also named in the suit, as was Caroline Ellison, the 20-something CEO of Alameda, and Constance Wang, who has been identified as FTX’s COO. Pogodin said he filed the lawsuit on behalf of an entity called Bitcoin Manipulation Abatement LLC.

SFGate linked to Pogodin’s lawsuit in this story about how SBF previously worked as a sports blogger; SBF’s blog was revealed in a screenshot of his Facebook page, which was included in Pogodin’s lawsuit. SFGate said the lawsuit was “dismissed” with prejudice, meaning it couldn’t be refiled, and likely settled out of court.

An email listed for Pogodin listed on his lawsuit bounced back; he didn’t respond to an email I sent him over LinkedIn. Pogodin’s lawsuit is posted on the website of the law firm Morrison Cohen, which tracks crypto litigation. The Morrison Cohen attorneys listed on the law firm’s “Cryptocurrency Litigation Tracker” page didn’t respond to an email.

One can make damning allegations in a lawsuit with near impunity, and if Pogodin’s claims weren’t tried before a judge or jury, it would be a mistake to take them as gospel. Nevertheless, he provided evidence seeming to back up some of his claims. As but one example, the lawsuit claimed that SBF changed his residence from Berkeley where FTX was founded to Hong Kong in order “to extricate himself from the jurisdiction of” the United States District Court for the Northern District of California where the lawsuit was filed.

To support his claim, Pogodin posted a screenshot of Bankman-Fried’s public social networking profile, which showed his California contact information had been scrubbed close to when Pagodin filed his lawsuit. Pogodin said SBF got wind of the lawsuit before it was filed.

According to Pogodin’s lawsuit, Alameda in 2019 already accounted for about 5% of the global crypo trading volume. “With such a large trading volume and thinly traded bitcoin markets, Defendants Alameda and Alameda BVI have had and continue to have the ability to move bitcoin market price very substantially,” the lawsuit said.

An industry league table included in Pogodin’s lawsuit revealed that Alameda ranked among the most profitable crypto traders. It’s comical that for an industry that claims supposedly superior transparency, the most profitable players aren’t readily identifable.

Pogodin alleged Alameda used illegal tactics to manipulate the market and profit considerably from the deception, but again his broad-based allegations haven’t been proven in court. SBF reportedly once referred to Alameda’s trading tactics and strategies as part of its “intellectual property.”

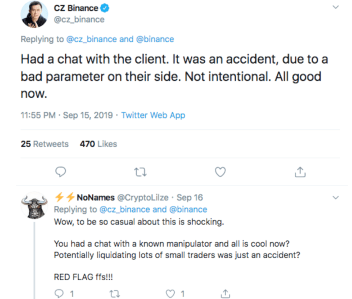

Pogodin’s lawsuit includes screenshots of tweets by Changpeng Zha, CEO of Binance, claiming the crypto trading firm’s surveillance team had uncovered attempts at market manipulation and seeming to blame the incident on SBF and his Alameda cohorts.

Changpeng subsequently reversed himself, saying the manipulation was done in error, but at least one industry participant took issue with the CEO’s position.

The legal merits of Pogodin’s lawsuit may be open to debate, but Bloomberg reported that federal prosecutors even prior to FTX’s collapse were conducting a sweeping probe of the global cryptocurrency markets, including FTX’s operations.

What’s notable is that after Pogodin’s lawsuit was dismissed or settled, FTX managed to raise hundreds of millions in venture capital funding for purposes the press has yet to make clear. In a remarkable scoop that so far has gone unnoticed, Fortune’s Luisa Beltran obtained Excel spreadsheets that SBF used for fundraising purposes.

From Fortune:

With each round FTX raised, Bankman-Fried sent a spreadsheet to potential investors displaying items like revenue, profit and losses, daily users, and expenses for FTX, according to an executive who received the documents . . . Fortune was sent two sets of spreadsheets on the condition that we could review but not publish the original documents, which were dated December 2021 and June 2022.

Taken together, the documents show an early picture of an outrageously fast-growing enterprise run by a founder who eschewed traditional management structures, board oversight, teams of accountants and lawyers, and other standard practices of businesses that grow to this size. The spreadsheets are a far cry from audited financials; rather, they appear to be homespun Excel files, which are at times confusing and have inaccurate labels.

They are sales documents and do not provide a clear accounting of how FTX was valuing its various tokens or liabilities when calculating figures such as ‘net profits’” . . . And yet Bankman-Fried was able to translate such documents into nearly $2 billion from some of the savviest investors around.

There appears to be a “Deep Throat” source leaking critical FTX documents to reporters, and I’d welcome knowing that person(s) motives. FTX’s collapse was sparked by this story in the trade publication CoinDesk, which obtained documents showing how FTX’s and Alameda’s operations were intricately linked. CoinDesk reported that Alameda had $14.6 billion in assets as of June 30, much of it manufactured currency issued by FTX.

What’s astounding is that SBF raised considerable funds from some of the most prestigious venture capital firms, including Sequoia, SoftBank, and Tiger Global Management. Even more astounding is that FTX was until recently valued at $32 billion, making me wonder how that valuation was determined and the legitimacy of the VC industry’s other valuations.

I seem alone in my alarm that SBF showered legions of Washington politicians with $40 million in campaign contributions, including those who promoted legislation SBF wanted that would have assured the lightweight CFTC had oversight over the crypto industry. Rest assured had 95 percent of the donations not gone to Democratic politicians, the legacy media would be squawking that all political recipients must return their SBF contributions.

One of SBF’s recipients was California’s Rep. Maxine Waters, chair of the House Committee that will investigate FTX’s collapse next month. Other Waters committee members also received SBF contributions.

This Thanksgiving SBF and his colleagues should give thanks that they will be judged by a jury of their peers.

Display art: ©burdnik/123RF.COM